ORANI-G-SL – A Computable General Equilibrium Model to Assess the Climate Change Impacts on Agriculture in Sri Lanka

Article Information

Walimuni Chamindri Sewanka Mendis Abeysekara1, 2*, Mahinda Siriwardana1, Samuel Meng1

1University of New England, Armidale, Australia

2University of Ruhuna, Matara, Sri Lanka

*Corresponding Author: Walimuni Chamindri Sewanka Mendis Abeysekara, University of New England, Armidale, Australia

Received: 15 June 2022; Accepted: 23 June 2022; Published: xxxx

Citation:

Walimuni Chamindri Sewanka Mendis Abeysekara, Mahinda Siriwardana, Samuel Meng. ORANI-G-SL - A Computable General Equilibrium Model to Assess the Climate Change Impacts on Agriculture in Sri Lanka. Journal of Environmental Science and Public Health. 6 (2022): 323-340.

Share at FacebookAbstract

This paper presents a detailed technical description of features added to the standard ORANI model to construct a CGE for Sri Lanka, referred to as the ORANI-G-SL. The adapted model introduces water as a production factor, distinguishes between rainfed and irrigated agricultural lands, and allows for substitution between these two major inputs. The paper also describes the model database and outlines the pre-simulation process of data transformation from the latest available national input-output table to the model database. The ORANI-G-SL is equipped to model the economywide impacts of climate change in Sri Lanka, the economic implications of increasing irrigation capacity for the continuing sustainability of national resources, and the potential efficiency of other climate change adaptation strategies. The model can be easily modified for use in other countries. Two simulation exercises were conducted to assess the validity of the model and demonstrate specific features. The first simulation analysed the economy-wide effects of losses of productivity in the agricultural sector due to climate change. The model results point to the likelihood of an overall reduction in agricultural output, resulting in escalating food prices, and a consequential decline in real GDP and future levels of employment. The second simulation analysed the economic impacts of agricultural land expansion as an adaptation strategy. The outcome projected overall economic gains, supporting growth in the economy of Sri Lanka.

Keywords

Agriculture, Climate Change, Computable General Equilibrium, Irrigation, Land.

Agriculture articles; Climate Change articles; Computable General Equilibrium articles; Irrigation articles; Land articles.

Article Details

3. Introduction

Agriculture is globally one of the major forms of human activity and livelihood, employing available land and water resources to feed the population. Undeniably, research in the related disciplines of soil chemistry, plant biochemistry, and environment studies, as well as the development of technology has boosted agricultural production over the last century. Yet, the uneven distribution of such scientific augmentation has failed to provide a proper solution for hunger and poverty in some parts of the world (Barrett, 2010). Currently, the agricultural sector faces a monumental challenge to feed the growing global population, projected to reach nine billion by 2050 (Godfray et al., 2010).

The agricultural sector and its production are intrinsically interlinked with climate and the environment. Topping all existing global challenges to food production and agro-based industry growth, is the impact of climate change. The agricultural sector will experience a greater economic impact from climate change in comparison with all other industries (Cline, 2007; Mendelsohn, 2008). In addition, rainfed agriculture is still the principal livelihood of the majority of rural populations in developing countries. The continuation of established rainy seasons with sufficient rainfall and optimum temperatures will continue to enhance productivity, ensuring food security. However, unpredictability of rainy seasons and the associated shortfalls in rainfall will reduce yield, leading to food insecurity.

As an island in the Indian Ocean and a developing nation, Sri Lanka is acutely vulnerable to changes in climate and the economic impacts thereof. It is evident from existing literature that mean annual temperatures and extreme weather events on the island indicate an increasing trend, and rainfall patterns are changing, making them unpredictable (Esham & Garforth, 2013; Panabokke & Punyawardena, 2010). Many studies have clearly elucidated that climate change in Sri Lanka have directly and indirectly impacted on the agricultural sector, imposing significant consequences for the economy and national food security (Ahmed & Suphachalasai, 2014; De Costa, 2008, 2010; De Silva, 2009; Eeswaran, 2018; Esham & Garforth, 2013; Premalal, 2009).

Historically, the agricultural sector has contributed the greatest share of GDP and has been the major source of employment in Sri Lanka. Due to structural transformation, the agricultural sector’s shares of GDP and employment now exhibit a steadily declining trend in relation to growth in the contributions of the manufacturing and services sectors. Further, the decline in the agricultural sector’s GDP share far exceeds its decline as a source of employment. Therefore, movement away from agriculture has certainly not been matched by job creation in the service and manufacturing sectors. As the agricultural sector is still the principal livelihood of many rural communities in Sri Lanka, these changes in agricultural productivity will ultimately impact the whole national economy. Hence, assessing the impacts of climate change on the agriculture sector, and consequently on the whole economy, is vital for the development of policy and planning adaptation strategies. Moreover, the implementation of specific planned developments for the agricultural sector and its output is regarded as crucial in achieving sustainable development goals in developing countries, and Sri Lanka is no exception.

Recognizing these issues, the Government of Sri Lanka has launched a national climate change policy and adaptation plan to mitigate the impacts of climate change on the country (Ministry of Mahaweli Development & Environment, 2012, Climate Change Secretariat, 2016). Agriculture and fisheries have been categorized as the most vulnerable sectors. Assessing these vulnerabilities to adverse climate impacts periodically and developing potential adaptation and mitigation strategies are part of the national climate change policy. Furthermore, scaling up climate change research and development, expanding agricultural lands, and increasing irrigation capacity have been identified as possible strategies in the adaptation policy. Thus, the purpose of this research study is to develop a mechanism to identify climate change-induced economic impacts on Sri Lanka and to analyse the effectiveness of specific adaptation strategies.

According to the Food and Agriculture Organization of the United Nations, agriculture accounts for 70 percent of global water withdrawal and 90 percent of water consumption (Kohli, Frenken, & Spottorno, 2010). In the light of these statistics, it is imperative to control and optimise water distribution and consumption in the agricultural sector as an adaptation strategy against climate change. In contrast, ineffectual water-usage policies providing water as an under-priced commodity or free resource have hindered the efficient distribution and usage of water resources. As national budgets and annual financial expenditure returns do not conventionally express water as a disaggregated component, there is a lack of recorded economic transactions related to water, which has limited the inclusion of water resources in economic models.

Despite these challenges, the Computable General Equilibrium (CGE) model, an accepted economic modelling approach, has been used by many scholars for climate change impact and adaptation assessments. CGE models can assess the impact of climate change on the agricultural sector by considering its interactions with other economic sectors, as well as determine the economy-wide impacts and the relative effectiveness of different adaptation strategies. This paper presents a development of the ORANI-G model known as ORANI-G-SL, which introduces water as an agricultural production factor and distinguishes between rainfed and irrigated agricultural land. It facilitates the assessment of adaptation strategies and alternative investment options, as to how these meet the challenges of climate change impacts on the agricultural sector in Sri Lanka and thereby the whole economy of the nation.

The paper is structured in five parts. The first section reviews the literature on similar economic models. The second section explains in detail the revised version of the model, the ORANI-G-SL. The third section describes the database development. The fourth section discusses the results of two simulations conducted using the ORANI-G-SL and the final section presents a conclusion.

4. Literature Review

Scholars have used economic models to investigate numerous water-related issues, such as its availability and usage in the agricultural sector and water policy. Partial equilibrium and CGE models have been applied to the analysis of similar water-related issues. Partial equilibrium methods can analyse water-related issues in a particular sector, in compliance with the assumption that it has no impact on other economic sectors, while CGE models can analyse impacts on the whole economy.

Nevertheless, incorporating water factors into a CGE model is challenging due to several factors. The agricultural sector consumes a major portion of water for production and it is natural to consider water as a factor within the production function. However, as water is generally a non-market commodity, it is difficult to calibrate the parameters which determine the marginal productivity of water for different sectors to include in a CGE model. Many input-output tables (I-O tables) are available for water collection, treatment, and supply, including the I-O table of Sri Lanka which records the water distribution transactions to other industries. However, these industries do not produce water and prices do not reflect the real production costs. Moreover, it is difficult to calculate the exact amount of rainwater and groundwater used for agricultural production, which also complicates the incorporation of water factors into a CGE model.

To overcome these challenges, scholars have used different approaches to incorporate the water component into CGE models. Berrittella, Hoekstra, Rehdanz, Roson, and Tol (2007), Sahlén (2008) and Tirado, Gomez, and Lozano (2006) introduced the concept of a water industry into the model. This method transforms rough water into effective water as an exogenous intermediate input for production and consumption. Another approach has been to embed the value of water within the value of land, assuming the source or supply of water to be a factor that determines soil characteristics, and thereby land value (Calzadilla, Rehdanz, & Tol, 2010). One group of researchers used agronomic studies to obtain water productivity values to include in CGE models (Roson & Sartori, 2015). Calzadilla, Rehdanz, Roson, Sartori, and Tol (2017) classified water-related simulation experiments into two categories. The CGE model has been used to assess the economy-wide impacts due to water resource changes driven by climate change (Calzadilla, Zhu, Rehdanz, Tol, & Ringler, 2013; Roson & Sartori, 2015; Taheripour, Hertel, & Liu, 2013), as well as to evaluate the impact of economic policies on water demand, consumption, etc.(Berrittella et al., 2007; Calzadilla, Rehdanz, & Tol, 2011b; Gomez, Tirado, & Rey?Maquieira, 2004).

As the ORANI-G-SL model differentiates between rainfed and irrigated agriculture by introducing water as a factor of production embedded in land rental, this study mainly reviews models that considered water as a factor of the land component. Such studies have been executed on both a regional and global scale.

Berck, Robinson, and Goldman (1991), followed by Robinson and Gehlhar (1995), Mukherjee (1996); Seung, Harris, MacDiarmid, and Shaw (1998); and Decaluwe, Patry, and Savard (1999) all embedded the water component into land rental to

analyse regional water-related issues in the 1990s. Berck et al. (1991) analysed the impact of reduced amounts of water as an agricultural input on aggregate Gross Domestic Production (GDP) for the southern portion of the San Joaquin Valley in California, using a multi-level function production technology for the agricultural sector with low and high elasticity variants. The agricultural sectoral capital varies with land use in the low elasticity variant and is fixed in the high elasticity variant. Robinson and Gehlhar (1995) and Mukherjee (1996) used a similar production function to analyse the efficiency of land and water use economic policies. At the top level of the nested structure of the sectoral production function, the sectoral output is a linear function of real value added and intermediate inputs. The intermediate inputs are required as fixed input-output coefficients and real value added is a constant elasticity of substitution (CES) function of primary inputs (labour, capital, and land/water aggregate), where the land/water aggregate is a linear aggregation. Seung et al. (1998) used a regional CGE model to assess the impact of water reallocation from agricultural to recreational use in rural Nevada and California. The production function has a quadruple nested structure. At the bottom level, water and acreage are combined in fixed proportions to produce land. Capital and land are then combined with a CES function to produce the capital/land aggregate, and another CES function is used to produce value added by combining labour and capital/land aggregate. At the top level, the output is a linear function of intermediates and value added. Decaluwe et al. (1999) analysed different water pricing schemes in Morocco. The agricultural production function consists of a four-level nested structure. At the bottom level, land and capital are combined with a CES function to produce land and capital composite, and another CES function is used to combine water and fertilizer to produce intermediate inputs.

Diao and Roe (2000), Gomez et al. (2004), D. C. Peterson, Dwyer, Appels, and Fry (2004) Peterson, Dwyer, Appels, and Fry (2005), van Heerden, Blignaut, and Horridge (2008), Mark Horridge and Wittwer (2008) and Dixon, Rimmer, and Wittwer (2009) all used regional CGE models to analyse water-related issues in the 2000s. (Table 1).

|

Author |

Modelling Approach (region) |

Research question and results |

Key points in Production function |

Role of water |

|

Gomez et al. (2004) |

Static regional model (Balearic Islands, Spain) |

Q: To analyse the welfare gains due to the allocation of water rights. R: Allocation of water rights are more advantageous than other alternatives. |

Used five production factors (land, labour, capital, water and sea water). Land is used only in the agricultural sector. Underground water and energy are combined at the bottom level to produce agricultural water. |

Water supply assumed to be fixed. Water is used by the agricultural sector for production, households for consumption and as an intermediate input in other industries. |

|

Peterson et al. (2005) |

TERM-Water CGE model (Southern Murray-Darling Basin, Australia) |

Q: To analyse the impact on water trading expansion of irrigation water. R: Water trading within irrigation districts is more beneficial than expansion of trade between regions. |

Considered irrigation water as an endowment in production and, hence, the production cost of the irrigation water is not a factor in the model. Irrigation water is combined with other non-water inputs with a CES function at the top level of the nested production function. |

Water supply is fixed exogenously. Water usage is limited to the agricultural sector. |

|

van Heerden et al. (2008) |

Static computable general equilibrium model – UPGEM (South Africa) |

Q: To analyse the impact of new tax policies on water demand by forestry and irrigated field crops. R: Tax on irrigated field crops is beneficial in the long run. |

Raw water is combined with primary factors and intermediate inputs, together with a Leontief technology function at the top level of the production structure. |

Water users are categorised into three groups, namely, agricultural sector, bulk users of non-potable water, and the remaining industries and households. |

|

Dixon et al. (2009) |

Dynamic CGE model TERM – H2O (Australia) |

Q: To analyse the impacts of inter-regional water trading (buyback scheme) R: Water rights holders can increase benefits by increasing irrigation water price. |

At the bottom level of the production function unwatered irrigable land is combined using a Leontief technology function water to produce irrigated land, which is combine with irrigable land and dry land using a CES function to produce effective land. Total land is produced by combining effective land with cereal land using a CES function. |

Water is used by the agricultural sector for irrigation. There are constraints on the volume of water traded between regions for irrigation. |

Table 1: Literature Review on Regional CGE-Water Models.

4.1 ORANI-G-SL Model

The ORANI-G-SL is a single-country CGE model. The model core follows the framework of the ORANI-G single-country generic computable general equilibrium model (Dixon, Parmenter, Sutton, & Vincent, 1982; Horridge, 2000) ORANI is a comparative static CGE model of the Australian economy, developed by the Centre of Policy Studies (CoPS) and Impact Project at Monash University in Australia (Horridge, 2003). It was developed to analyse policy successes and failures in Australia. ORANI-G is an adapted version of ORANI, which has served as a foundation for the construction of many new models (Lkhanaajav, 2016).

Since the study's primary focus is on the agricultural sector, the model was modified by disaggregating agricultural land into irrigated land and rainfed land. Achieving this fundamental modification involved the following three main steps.

The first step required calculating the model's data requirements - the traditional I-O table is not sufficient for fitting the irrigation-oriented ORANI–G-SL model, since it makes no distinction between irrigated and rainfed land. For this purpose, detailed statistics on irrigated and rainfed land usage according to agricultural activities, data on land rentals, and certain elasticity parameters were obtained from the Department of Census and Statistics, Ministry of Agriculture, Department of Irrigation, International Food Policy and Research Institute (IFPRI), and existing literature.

The Land included in the traditional I-O table as a factor of production is defined as “the ground itself, including, the soil covering and associated surface water” (United Nations, 1993). Hence, it is assumed the value of the irrigated water is incorporated in the land value in the I-O table. To split this land value into rainfed and irrigated land, we followed the methodology used by Calzadilla, (2013). The land was, thus, disaggregated using its proportionate contribution of irrigated and rainfed land to the total area of each agricultural crop. Accordingly, the balance of the original I-O table remains unchanged as the value of the land is split rather than altered.

|

Crop |

Rainfed Agriculture (thousand ha) |

Irrigated Agriculture (thousand ha) |

Total (thousand ha) |

Share of Irrigated Agriculture (%) |

|

Cereals |

21.76 |

13.01 |

34.77 |

37.42 |

|

Rice |

400.29 |

438.03 |

838.32 |

52.25 |

|

Vegetables |

67.96 |

9.15 |

77.11 |

11.86 |

|

Tropical and subtropical fruits |

28.47 |

15.90 |

44.37 |

35.83 |

|

Other fruits |

6.46 |

3.73 |

10.19 |

36.61 |

|

Nuts (excluding wild edible nuts and groundnuts) in shell |

4.18 |

2.43 |

6.61 |

36.70 |

|

Oilseeds and oleaginous fruits |

5.13 |

1.56 |

6.70 |

23.34 |

|

Coffee, green & cocoa beans |

8.88 |

5.13 |

13.98 |

36.46 |

|

Tea leaves |

146.55 |

73.71 |

220.26 |

33.47 |

Table 2 : Baseline data: Crop area by land type

Source: International Food Policy and Research Institute (IFPRI)

Theoretical modifications were then made to the standard ORANI-G model by expressing the equations in a suitable form to construct the ORANI-G-SL model (to build a model within GEMPACK, it is necessary to prepare a TABLO Input file containing the equations of the model). Finally, a database for the ORANI-G-SL was developed based on the Sri Lankan I-O table and other data collected.

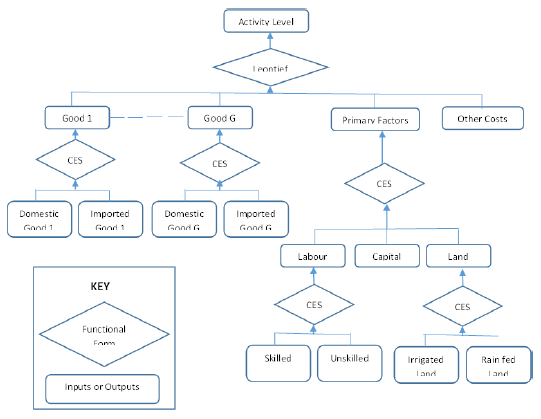

As the major modification involved the production structure, an overview of the model's adapted production structure follows in Figure 1. At the top nest of the production function, the output is a Leontief function of intermediate inputs and primary factors. At the Armington nest, each intermediate input is a CES combination of imported and domestic goods. At the primary factor nest, land, labour, and capital are combined using a CES function to produce primary factors. At the bottom level, labour is a CES function of skilled and unskilled labour and the land is a CES function of irrigated and rainfed land (Figure 1).

The ORANI-G model incorporates a multitude of equations, fully explained by (Horridge, 2003). To implement the ORANI-G-SL model, some equations from the ORANI-G were altered, and certain new equations were added, for example, the demand and cost functions for the rainfed and irrigated land composite. As illustrated in Figure 1, a CES function is used to represent the producer's behaviour in selecting irrigated land or rainfed land as an input. Horridge (2000) has explained the percentage change equations of a CES nest function, as used in ORANI–G, in detail. Following Horridge (2000), demand and cost functions for rainfed and irrigated land composite were added to the model and coded in TABLO language according to the ORANI-G-SL notation (ORANI-G-SL code is available on request).The TABLO coding of the nested structure in Figure 1, predominantly focused on the land CES function as it forms the novel addition to the model, is attached in Annexure 1.

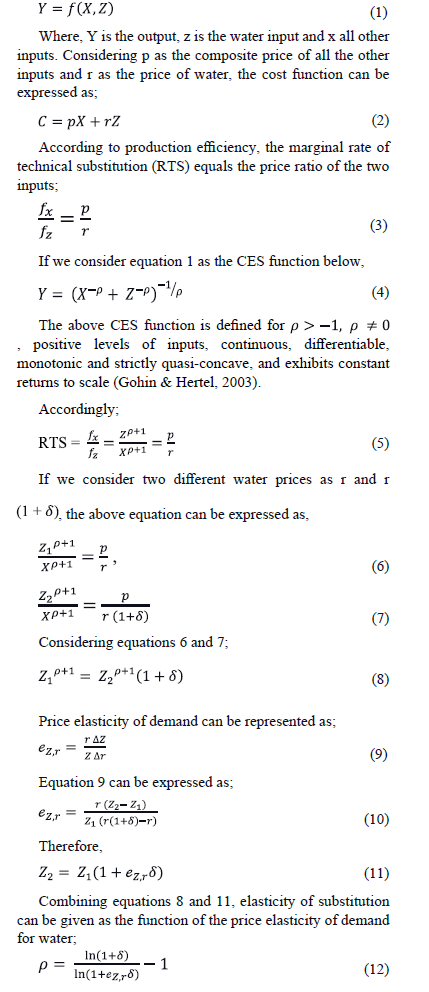

In the ORANI-G-SL model, it is also assumed that rainfed lands can be converted into irrigated lands by applying water. Elasticity of substitution values are readily obtainable from the GTAP-W model provided for the South Asian region (Calzadilla, Rehdanz, & Tol, 2011a). However, it is more appropriate to calculate the elasticity of substitution values specific to Sri Lanka. Therefore, the elasticity of substitution between irrigated land and rainfed land was calculated using the price elasticity value of water estimated by Dharmaratna and Parasnis (2010) for Sri Lanka. Calculations were done using the following equations:

The two-input production function is represented in the following equation;

The estimated value for price elasticity demand for water as calculated by Dharmaratna and Parasnis (2010) is -0.15. Using equation 12, the elasticity of substitution between irrigated land and rainfed land was calculated as 0.05. The elasticity of substitution used in the GTAP-W model for the South Asia region is 0.06. The ORANI – G-SL model, however, will incorporate the calculated value for Sri Lanka based on the elasticity of substitution between irrigated and rainfed lands.

The model was then validated to ensure its accuracy. A real homogeneity test was conducted to establish whether the model satisfied the constant returns to scale condition. All real variables in the exogenous list were shocked by X% and examined as to whether each was changed by X%, while the nominal variables remai need unchanged in the solution. The ORANI-G-SL model satisfied the above homogeneity test.

4.2 Database Development

4.3 Input-Output Data Tables

Implementation of the CGE model requires two types of principal sources of data, namely, an economy-wide I-O table or Social Accounting Matrix (SAM) and a set of values for the selected elasticity parameters. The I-O table represents the economic status quo, which is the initial solution of the model (Dixon et al., 2009). The most recently updated I-O table, compiled by the Department of Census and Statistics (DCS) in Sri Lanka, was used to develop the ORANI-G-SL model.

The first set of DCS-developed tables is known as the "supply-and-use tables" (SUTs), which balance the supply and use of each product in the economy. The tables describe the process of allocating various goods and services obtained locally or imported for various intermediate or final uses, including exports. These matrices provide a solid framework to balance the supply and use of commodities in an economy.These two tables are then transformed into a single table in which row and column totals are equal, to compile an economy-wide I-O table.

A simplified version of Sri Lanka's I-O table is shown in Table 3. It consists of three quadrants (Q1, Q2, and Q3). The first quadrant (Q1) shows the flow of goods and services between domestic industries. Q1 column values indicate the amounts of intermediate inputs used by each industry, and the row values the proportion of each industry's output absorbed by the other industries in the economy. Simply, each cell (rowiand columnj) in Q1 specifies the amount of industryi'soutput absorbed by the industryjfor its current production. All the data in Q1 is valued at the basic price. The second quadrant (Q2) in Table 3 shows the disposition of industryi'soutput for final consumption, capital formation, and exports. The summation of values in each row of Q1 and Q2 provides the total usage of each industry's goods and services. Quadrant three (Q3) in Table 3 shows the entries usually referred to as value additions. These include compensation for employees, taxes on production, consumption of fixed capital, and operating surpluses.

Table 3 : Basic Format of Sri Lanka’s I-O Table

The USE table compiled by the DCS comprises three tables, namely, the Total Use Table, Domestic Use Table, and Import Use Table (Tables 4, 5, and 6). A separate row in each table indicates the values of net indirect taxes or subsidies, which represent the payment made to or received from the government for a single unit of a good or service in the intermediate consumption or final demand. In the SUTs and I-O table, basic import flow values include the cost insurance freight values (cif).

Since this study uses the ORANI-NM (no margins) model, margins were treated as services in the USE matrix (e.g., transport margin is viewed as transport service). Therefore, the margin values of transportation and trading were added to their base values. Similarly, margin values were also incorporated into the supply matrix, in order to leave the margin matrices null.

|

Total USE table |

Intermediate Demands |

Final Demand |

Total |

||||||

|

Agric. |

Manufac. |

Servic. |

H/H |

Gov. |

Invest. |

Exports |

Stocks |

||

|

Agric. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Manufac. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Servic. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Margins |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Indirect tax |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Opp. Surplus |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Labour |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Prod. Tax |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Total |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

Table 4 : Total USE Table

|

Domestic USE table |

Intermediate Demands |

Final Demand |

Total |

||||||

|

Agric. |

Manufac. |

Servic. |

H/H |

Gov. |

Invest. |

Exports |

Stocks |

||

|

Agric. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Manufac. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Servic. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Margins |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Indirect tax |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Opp. Surplus |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Labour |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Prod. Tax |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Total |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

Table 5: Domestic USE Table

|

Import USE table |

Intermediate Demands |

Final Demand |

Total |

||||||

|

Agric. |

Manufac. |

Servic. |

H/H |

Gov. |

Invest. |

Exports |

Stocks |

||

|

Agric. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Manufac. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Servic. |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Margins |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXX |

XXXXX |

|

Indirect tax |

0 |

0 |

0 |

- |

- |

- |

- |

- |

XXXXX |

|

Opp. Surplus |

0 |

0 |

0 |

- |

- |

- |

- |

- |

XXXXX |

|

Labour |

0 |

0 |

0 |

- |

- |

- |

- |

- |

XXXXX |

|

Prod. Tax |

0 |

0 |

0 |

- |

- |

- |

- |

- |

XXXXX |

|

Total |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

XXXXX |

Table 6: Import USE Table

|

MAKE MATRIX |

Agric. |

Manufac. |

Servic. |

Total |

|

Agric. |

xxxxx |

xxxxx |

||

|

Manufac. |

xxxxx |

xxxxx |

||

|

Servic. |

xxxxx |

xxxxx |

||

|

Margins |

xxxxxx |

xxxxx |

xxxxx |

xxxxx |

|

Total |

xxxxx |

xxxxx |

xxxxx |

xxxxx |

Table 7: MAKE Matrix

The row totals in Tables 4, 5, and 6 represent the number of total goods and services (Commodities "C") supplied by each industry at unit cost, while the column total denotes the total demand or total amount of commodities absorbed by each industry ("I") for its current production cycle. The simplified version of Sri Lanka's SUTs, exhibits three commodities and three industries, namely, "Agriculture," "Manufacturing," and "Services." Thus, the matrix is symmetrical, comprising an equal number of commodities and industries. Similarly, this study employs a symmetric I-O table benchmarked for the year 2010, the most up-to-date I-O table published by the DCS, consisting of 127 industries and 127 commodities. A highly aggregated version of this I-O table based on real values can be found in Annexure 2.

In the ORANI-G model, total demand must be equal to total domestic supply. Therefore, the column totals in the Total USE table (Table 4) must be equal to the column totals of the MAKE matrix (Table 7), while the row totals of the domestic USE table (Table 5) must be equal to the row totals of the MAKE matrix (Table 7). Hence, the MAKE matrix denotes each commodity's domestic production level (row headings) by each industry (column headings).

In addition to the I-O table, different elasticity data, such as elasticities for substitution between domestic and imported sources (Armington elasticities) of commodities, elasticities of substitution between primary factors, household expenditure parameters, and export demand elasticities, are required to implement the model. Readily available data for elasticities were obtained from the GTAP database.

4.4 I-O Table data transformation into the ORANI-SL format

The next requirement was the transformation of data in the Sri Lankan I-O table into the ORANI-G-SL format (Figure 3) to implement the model. As the ORANI-G model is accessible for modification, the ORANI-G-SL has extended the standard ORANI-G structure to divide the agricultural land factor into rainfed and irrigated agricultural land.

Any economic system should apportion its available resources among its economic agents such as producers, investors, households, non-nationals, and governmental agencies for their competing uses. Economics examines the bases for and efficiency of decision-making in allocating these resources among economic agents in an economy. Households make decisions in order to maximize their utility under budget constraints, while producers make decisions to maximize their profits (minimize their cost) under production technology constraints. This optimizing behaviour by economic agents will reveal the market price, which is determined by market equilibrium. Hence, this behaviour may be captured in an economy-wide general equilibrium framework.

The basic structure of the ORANI-SL model and the data required to construct a country-specific ORANI –G-SL model is presented in Figure 2. The model is split into the series of demanders listed below:

- Domestic producers divided by I industries;

- Investors divided by I industries;

- A single representative household;

- An aggregate foreign purchaser of exports;

- Government demands;

- Changes in inventories;

|

Absorption Matrix |

|||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

||

|

Producers |

Investors |

Households |

Exports |

Government |

Change in Inventories |

||

|

Size |

I |

I |

1 |

1 |

1 |

1 |

|

|

Basic flow |

C x S |

V1BAS |

V2BAS |

V3BAS |

V4BAS |

V5BAS |

V6BAS |

|

Taxes |

C x S |

V1TAX |

V2TAX |

V3TAX |

V4TAX |

V5TAX |

|

|

Labour |

O |

V1LAB |

|||||

|

Capital |

1 |

V1CAP |

|||||

|

Land |

L |

V1LND |

|||||

|

Production tax |

1 |

V1PTX |

|||||

|

Other Costs |

1 |

V1OCT |

|||||

|

Make Matrix |

|

|

Size |

I |

|

C |

MAKE |

|

Import Duty |

|

|

Size |

1 |

|

C |

V0TAR |

|

C- Number of Commodities (127) I – Number of Industries (127) S – Domestic / Import O – Number of Occupation types (2) L – Number of Land types (2) |

Figure 2 : Structure of the ORANI-SL database

Values in each column in the absorption matrix indicate the structure of the purchases made by each demander mentioned under the respective column headings. Firstly, commodities (C) in an economy, obtained either domestically or imported, are used by producers as inputs to produce current goods and services (V1BAS) and for capital formation (V2BAS). These commodities are also consumed by households (V3BAS), governments (V5BAS) and are exported (domestic produced goods only) (V4BAS) or adjusted based on inventories (V6BAS). All these are valued at the basic price.

Secondly, commodity taxes (mentioned in the second row), which are associated with the purchases of each agent, are payable by the producers on purchases. Finally, apart from the intermediate inputs, primary factors such as labour (divided into O occupations) (V1LAB), capital (V1CAP), and land (V1LND, divided into L land types; rainfed or irrigated) are used for current production. Values in the production tax row (V1PTX) indicate the output taxes or subsidies, while the values in the other cost row (V1OCT) indicate various costs to firms.

Any industry is capable of producing any commodity in the economy. Therefore, the MAKE matrix at the bottom of Figure 2 shows the values of the output of each commodity type produced by each industry. The summation of values in each column in the MAKE matrix must be equal to the total cost of the absorption matrix. By convention, the row totals associated with each commodity in the MAKE matrix must be equal to the total domestic production value of the respective commodity plus the direct and indirect usage of (domestic) margin commodities. The last matrix in Figure 2 represents the import tariff revenue (V0TAR).

Margin values (transport and trade) obtained from Sri Lanka's supply table were added to the I-O table base values. The import duty matrix was created based on the import-related data incorporated into the supply table. In addition, the supply table also provides data on indirect taxes and subsidies relevant to each commodity. The data transformation steps conducted to transform the I-O table data into the ORANI-SL structure are described below.

- Investment Matrix

In the standard Sri Lankan I-O table, the investment or the Gross Fixed Capital Formation (GFCF) is displayed in a single column in the final demand quadrant (Q2) in Table 2. The 127-row column vector indicates the total demand for each commodity for fixed capital formation and must be transformed into a 127-commodity by 127-industry matrix to implement the ORANI-SL database represented in Figure 2.

As there was no additional information found relating to the investment matrix, the fixed capital formation column values contained in the Sri Lankan I-O table were apportioned among the 127 industries based on the input demand and the assumption that larger usage inputs by industries carry a greater investment weight.

|

A |

B |

C |

D |

E |

F |

Total |

GFCF |

|

|

X |

A |

TRA |

IA |

|||||

|

B |

TRB |

IB |

||||||

|

C |

TRC |

IC |

||||||

|

D |

TRD |

ID |

||||||

|

E |

TRE |

IE |

||||||

|

F |

TRF |

IF |

||||||

|

TCA |

Total |

TCB |

TCC |

TCD |

TCE |

TCF |

Table 8: Creation of Investment Matrix

Where;

TCA is the total of column A

TRA is the total of row A

Therefore, the V2BAS value for cell X = (X/TRA) x IA.

For example, in the Sri Lankan I-O table, the commodity coffee demand by the chocolate production industry rupees is ‘000 Million 439.1, and the total demand for the commodity coffee by all the industries in the economy is rupees ‘000 Million 1,364.5. The respective GFCF value for the commodity coffee is rupees ‘000 Million 2.4. Therefore, the allocation of investment in commodity coffee by the chocolate production industry is 0.7723.

Using the above share weight method, data in the I-O table can be transformed to fit the ORANI-SL investment matrix by distributing the Gross Fixed Capital Formation Values according to the intermediate input use matrix. Having created the 127- commodity by 127-industry investment matrix, the next step was to derive the tax matrix.

4.6 Tax Matrix

The standard DCS I-O table contains only a single row representing taxes less subsidies on domestic production and imports. To develop tax matrices, it is vital to separate taxes on domestic production and taxes on imports. Fortunately, the DCS supply table makes this distinction and presents taxes on domestic production and on imports for each commodity or product in separate columns. Thus, the domestic production taxes column in the supply table were transformed into values for the 127 industries based on the input demand of the domestic production matrix and, similarly, the taxes on imports column was expanded among 127 industries based on the input demand of the imports matrix. The method is similar to the data transformation procedure of the investment matrix.

The Row and Sum (RAS) procedure was conducted to ensure that the taxes less subsidies on products column in the supply table and taxes less subsidies in production and imports row in the I-O table met the row and column restrictions. This method eliminates minor inconsistencies arising from the manipulation of data obtained from two different sources, namely, the supply and I-O tables. The taxes less subsidies on products column total in the supply table was found to be equal to the taxes less subsidies in production and imports row total in I-O table. Further, the manipulated data approximated the targeted columns/rows. According to M Horridge (2001), the RAS method will fail to meet the requirement that target row totals equal the sum of target column totals when there is a significant difference between some target row and column totals in the original matrix or if some original matrix components are not positive.

Resultant values, other raw data in the I-O table, and elasticity values were saved in Header Array files (HAR files), a binary file type employed in GEMPACK. Hence, all the ORANI-G-SL model data can be viewed using the dedicated program, ViewHAR.

4.7 Climate Change Simulations

This section presents the results of two simulation exercises to demonstrate the new features of the ORANI-G-SL model. Firstly, the ORANI-G-SL model is used to assess the impacts of climate induced agricultural productivity changes on the overall economy in Sri Lanka. Secondly, the economic impacts of the expansion of agricultural land area (both rainfed and irrigated land) were assessed as an adaptation strategy.

- Simulation 1- Climate change impact simulation

This simulation was based on the data obtained from a literature survey on climate change impacts on crop productivity in Sri Lanka. Table 9 summarises projected future climate change impacts on rice, cereal (maize, wheat, millet, and sorghum), rubber, vegetable, coffee, and tea crops in Sri Lanka, based on the findings of the relevant studies.

|

Crop |

Crop productivity change |

Source |

Comments |

|

Rice |

6.6% increase |

Knox, Hess, Daccache, and Wheeler (2012) |

|

|

3% increase |

Lal (2011) |

Irrigated Rice due to CO2 increase and 10C thermal stress |

|

|

6% increase |

Lal (2011) |

Rainfed Rice due to CO2 increase and 10C thermal stress |

|

|

2.2% decline |

Roson and Sartori (2016) |

||

|

5.40% increase |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

||

|

5% decline |

Hertel, Burke, and Lobell (2010) |

Medium Productivity Scenario |

|

|

Cereal |

3.4% decline |

Roson and Sartori (2016) |

Maize due to 10C thermal stress |

|

9.22% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

Maize |

|

|

10% decline |

Hertel et al. (2010) |

Medium Productivity Scenario |

|

|

3% decline |

Hertel et al. (2010) |

Medium Productivity Scenario |

|

|

2.2% increase |

Roson and Sartori (2016) |

Wheat due to C 10C thermal stress |

|

|

3.86% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

Millet |

|

|

13.63% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

Sorghum |

|

|

Rubber |

4.70% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

|

|

Vegetables |

2.94% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

|

|

Coffee |

6.42% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

|

|

Tea |

5.22% decline |

Extended results of Rosegrant et al. (2017), Robinson et al. (2015) |

Table 9 : Literature survey on climate change impacts on the crop productivity in Sri Lanka

Overall, some studies expect positive impacts on certain crops such as rice and wheat, while the majority of agricultural crops will be negatively impacted by future changes in climate. Based on the impact assessment-related literature survey summarised in Table 9, the crop productivity impacts on rice, cereal (maize, wheat, millet, sorghum), rubber, vegetables, coffee, and tea crops were averaged to shock the ORANI-G-SL model (Table 10). This average was calculated to overcome the irregularities of the assessments, the non-uniformity of the methodology, and the time scale differences of earlier literature.

|

Crop |

Average productivity impact |

|

Rice |

2.3 |

|

Cereals (Maize, Wheat, Millet, Sorghum) |

-5.84 |

|

Rubber |

-3.15 |

|

Vegetables |

-1.94 |

|

Café |

-4.33 |

|

Tea |

-3.34 |

Table 10 : Average climate change-induced crop productivity impacts

The ORANI-G-SL model can be used for both short-run and long-run policy analysis by defining the closure of the model. The authors included a short-run model closure to analyse the economic impacts of climate-induced productivity changes in the short-run (simulation 1). Hence, real wages and aggregate real investment expenditure were considered to be exogenous which allows the determining of the aggregate employment and rates of return on the capital endogenously. Alternatively, in short-run analysis, aggregate household consumption, aggregate government expenditure, and net trade balance are assumed to be endogenous (Figure 3). The above crop productivity changes were inputted into the model as a percentage change of the total factor productivity of each crop, and the outcome of each simulation was analysed and interpreted as a percentage change deviation from the base year.

- Simulation 2 – Expanding agricultural land area

Simulation 2 analyses a possible adaptation strategy to ameliorate the climate change impacts on the agricultural sector in Sri Lanka. This can be achieved by using more intermediate inputs, and more land and labour or by improving the productivity of intermediate inputs, land and labour. Simulation 2 analyses the economic impacts of expansion of agricultural land area in Sri Lanka as an adaptation strategy to mitigate the climate change impacts on the agricultural sector in Sri Lanka. Agricultural land area has been predicted to contract in some countries, while in others it will expand in the future, ensuring food security. For example, in China it will contract by 0.18% annually, while in Sub-Saharan Africa it is predicted to increase at a rate of 0.6% per annum (Calzadilla, Rehdanz, et al., 2013; Calzadilla, Zhu, et al., 2013). The results of this study, obtained using an IMPACT model under the SSP2 and RCP8.5 scenarios, has projected that the agricultural land area in Sri Lanka will be expanded in the future, in order to increase the crop production levels required to meet the increasing demand of a growing population (Table 11). This is supported by the National Land Use Policy in Sri Lanka (NLUP) (Department of Land Use Policy Planning Sri Lanka, 2017). The objectives of the NLUP support the possible option of expanding agricultural land in Sri Lanka. These objectives include the prioritising of agriculturally-oriented usage of land as a means to strengthen the national economy in order to ensure present and future food security, through the expansion of agricultural land to achieve self-sufficiency in food production, by enhancing the contribution of extensive currently-underutilized land and areas yielding low productivity, together with the development of appropriate land usage of abandoned agricultural land in the plantation sector of the national economy, and all marginal and uncultivated land.

This simulation was based on the extended results of Rosegrant et al. (2017) and Robinson et al. (2015). The main objective of the simulation was to demonstrate a further important feature of the ORANI-G-SL model. In the original ORANI-G model, agricultural land is fixed, but there is no specification regarding the allocation of individual crops to irrigated or rainfed land. However, the ORANI-G-SL model distinguishes between rainfed and irrigated land areas on the basis of crop types. Hence, this enhanced level of adaptation strategy analysis has been made feasible by the ORANI-G-SL model developed by the authors.

|

Crop |

2010 |

Long-run expansion of land area due to Climate Change |

% Change of Land Area compared to Baseline Scenario * |

|||

|

Baseline Scenario |

||||||

|

Rainfed |

Irrigated |

|||||

|

Rainfed |

Irrigated |

Rainfed |

Irrigated |

|||

|

Cereals |

21.76 |

13.01 |

24.91 |

15.22 |

14.46 |

17.02 |

|

Rice |

400.29 |

438.03 |

418.16 |

468.74 |

4.46 |

7.01 |

|

Vegetables |

67.96 |

9.15 |

80.23 |

9.95 |

18.05 |

8.71 |

|

Tropical & subtropical fruits |

28.47 |

15.9 |

38.54 |

19.33 |

35.39 |

21.56 |

|

Other fruits |

6.46 |

3.73 |

9.79 |

5.35 |

51.52 |

43.32 |

|

Nuts |

4.18 |

2.43 |

4.12 |

2.07 |

-1.35 |

-14.98 |

|

Oilseeds |

5.13 |

1.56 |

6.4 |

1.82 |

24.82 |

16.93 |

|

Coffee, cocoa |

8.88 |

5.13 |

10.04 |

5.42 |

13.08 |

5.69 |

|

Tea leaves |

146.55 |

73.71 |

168.11 |

79.01 |

14.71 |

7.2 |

Table 11: Crop area by '000 Ha under land type’, with long-run climate change for Sri Lanka

Source : Extended results of Rosegrant et al. (2017), Robinson et al. (2015) Note: *authors’ calculations

As mentioned in the previous section, the ORANI-G-SL model can be used for both short-run and long-run policy analysis by defining the closure of the model. Simulation 1 used a short-run closure. In order to demonstrate the model’s validity in long-run policy analysis, Simulation 2 uses a long run, model closure, under which aggregate employment and rate of return on capital are assumed to be exogenous. Aggregate household consumption and government expenditure and investment will adjust to produce real GDP from the expenditure side. The above changes in the land were inputted into the model as a percentage change of the total rainfed and irrigated endowment of each crop, and the outcome of each simulation was analysed and interpreted as a percentage change deviation from the base year.

5. Results and discussion

The projections of the two simulations were analysed in terms of; (i) the implications for the major macroeconomic variables of climate change-induced agricultural productivity changes, and (ii) the potential for economic mitigation of agricultural land expansion as an adaptation strategy. Table 12 expresses the projected impact on macroeconomic factors of the two simulations as percentage deviations from the study baseline.

|

Variable |

Simulation 1 |

Simulation 2 |

|

short-run % change |

long-run % change |

|

|

Real GDP |

-0.092 |

1.505 |

|

Household consumption |

-0.143 |

1.995 |

|

Net exports |

-0.011 |

1.443 |

|

Aggregate employment |

-0.052 |

0 |

|

Consumer price index (CPI) |

0.25 |

-4.132 |

|

Real wages |

0 |

10.311 |

Table 12: Projected macroeconomic effects of climate change impacts on the agricultural sector in the short-run and expansion of agricultural land in the long-run

5.1 Results of Simulation 1

Many researchers use the changes in real GDP as an indicator for examining the economic impacts of climate change-induced agricultural productivity changes. The simulated results indicate that the projected crop productivity losses will affect the real GDP negatively in the short-run. The magnitude of the negative impact will be a 0.092% decline in comparison with the baseline status. It also indicates that climate change is projected to impact adversely on the labour market, causing a 0.52% reduction in employment, hence increasing unemployment and reducing household income. Exacerbating household distress, commodity prices are projected to increase in the future, as indicated by a 0.250% increase in the consumer price index. Moreover, according to the model results, real consumption is projected to decline by 0.143%, a slightly greater drop than that of GDP in the first scenario. Due to higher commodity prices, household consumption will be reduced. As mentioned earlier, domestic production levels are projected to fall, with imports declining by 0.067%, thus reducing the variety of commodities available for household consumption. Exports will decline by 0.078%, leading to a net export reduction of 0.011%. Overall, future climate-induced productivity changes will lead to a contraction of the economy by increasing the rate of unemployment and prices of commodities, thus reducing future household consumption and welfare levels.

A major consequence of macroeconomic deterioration such as a reduction in GDP and a rising consumer price index is a decline in agricultural production and an increase in agricultural commodity prices. As illustrated in Table 13 below table, the majority of agricultural commodities will be adversely affected by climate change-induced productivity changes. Decline in the output quantity of these products will increase the short-run market price. The other two economic sectors (manufacturing and services) will experience mixed impacts due to the impacts of climate change on the agricultural sector.

|

Commodities |

Output |

Prices |

|

Cereals |

-1.406 |

6.809 |

|

Rice |

0.307 |

-8.035 |

|

Vegetables |

-0.728 |

2.467 |

|

Mushrooms and truffles |

-0.089 |

-0.049 |

|

Other Vegetables, fresh |

-0.338 |

0.294 |

|

Tropical and subtropical fruits |

-0.098 |

-0.262 |

|

Other fruits |

-0.455 |

0.225 |

|

Nuts (excluding wild edible nuts and groundnuts), in shell |

-0.072 |

-0.326 |

|

Oilseeds and oleaginous fruits |

-0.183 |

0.074 |

|

Coffee, green & Cocoa beans |

-2.482 |

5.725 |

|

Tea leaves |

-0.089 |

23.393 |

|

Stimulant, spice and aromatic crops |

-0.089 |

-0.327 |

|

Sugar crops |

-0.02 |

1.451 |

|

Natural rubber in primary forms or in plates, sheets or strip |

-0.212 |

14.052 |

|

Unmanufactured tobacco |

-0.062 |

2.551 |

|

Forage products, fibres, living plants, cut flowers and flower buds, |

-0.162 |

-0.406 |

|

Live animals & Other animal products |

-0.047 |

-0.003 |

|

Raw milk |

-0.038 |

-0.184 |

|

Eggs of hens or other birds in shell, fresh & Reproductive materials of animals |

-0.064 |

-0.308 |

|

Support services to agriculture, hunting, forestry, fishing, mining and utilities |

-0.043 |

0.259 |

|

Logs of coniferous wood and non-coniferous wood |

-0.004 |

-0.029 |

|

Fuel wood, in logs, in billets, in twigs, in faggots or in similar forms |

-0.176 |

0.059 |

|

Non-wood forest products |

-0.227 |

0.246 |

|

Fish and other fishing products |

-0.073 |

-0.285 |

Table 13: Impact of climate change on agricultural output and commodity prices of in Sri Lanka

future Overall, agricultural outputs are projected to decline in the short-run scenario compared to the baseline situation, with rice the only exception. According to the table 9 and 10, findings of most of the research studies predicts a positive impact of climate change on rice productivity. This will lead to an increased production of rice in the short run. Although rice is the staple food of Sri Lanka, other agricultural products such as cereals and plantation crops (specially export agricultural crops) play a considerable role in rural livelihoods and agriculture. Therefore, the projected decline in agricultural commodity outputs will pose a threat to food security in Sri Lanka in the future. Consequently, the decline in output will lead to an upsurge in the prices of the associated products (as indicated in Table 13), emphasising the potentially disastrous implications of projected climate changes for agriculture, notwithstanding a concurrent crisis in national food security.

As the country is expected to experience inflation in food prices in the future, households are likely to reduce the quantities of food consumed in comparison with the baseline scenario. The results presented in Table 12 indicate a 0.143% decline in household consumption due to the impact of climate change on the agricultural sector.

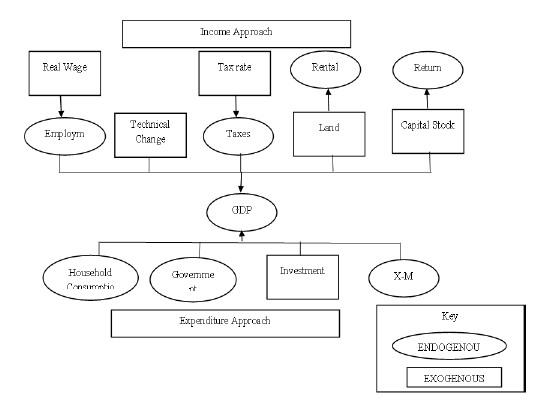

The expenditure approach, as represented in Figure 3, calculates real GDP by determining the summation of household consumption, government expenditure, investment and net exports. Government expenditure follows household consumption and the aggregate real investment is fixed in the short run as shown in Figure 3. Our model results, thus, predict a decline in household consumption and government expenditure, as a result of climate-induced productivity changes in the agricultural sector. As discussed above, net exports are predicted to shrink and the country is likely to run a continuous trade deficit in the future. Hence, declining expenditure-side factors contributing to GDP will lead to a fall in real GDP in the short run.

The alternative income approach can also be used to understand and describe the economic impacts of climate-induced agricultural sector productivity changes. This necessitates an analysis of the income-side factors contributing to real GDP, as shown in Figure 3. Implicit to simulations under the ORANI-G-SL framework, firms are assumed to have zero profits and tax policies undergo no changes. Therefore, it is vital to focus on the other three contributing factors. The adverse impacts of climate change on the agricultural sector will logically increase the demand for land to be used for crop production to feed the increasing population, which will drive up the real prices of land in the future. Proof of this, can be found in our model’s prediction of a 7.571% increase in land rentals, which signals an increase in production costs. This in turn impacts negatively on the labour market in general equilibrium models, by reducing aggregate employment. Similarly, returns to capital are predicted to drop by 1.165% due to climate-induced agricultural sector productivity changes. Overall, this agricultural sector productivity decline will reduce agricultural commodity outputs and lead to an increased demand for land for agricultural crop production. Higher demand for lands will drive up the land rental and this will in return cause a decline in aggregate employment and return to capital. Hence, the impacts of climate change will lead to a decline in national income in Sri Lanka in the short run.

5.2 Results of Simulation 2

The results of Simulation 2 are presented in Table 12. As discussed above, the projected long-run expansion of land for agricultural purposes would offset the negative sectoral impacts of climate change. The expenditure-side calculation of real GDP is achieved by the summation of the macro-economic factors of household consumption, government expenditure, investments, and net exports. Simulating the adaptation strategy of assigning more land to agricultural production, the model projected a 3.61% decline in the CPI, reflected in a 1.99% increase in household consumption. The projected 10.31% real wage increase would boost domestic breadwinner income, substantiating the rise in household consumption, while net exports were predicted to grow by 1.443%. The model forecast of a 1.5% increase in real GDP confirms the economy-wide benefits of extending agricultural sector land to increase production.

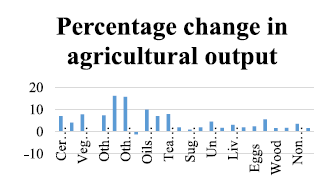

Analysing the impacts agricultural land expansion as a climate change adaptation strategy offers on the disaggregated production outputs of the agricultural sector constitutes a valid corroborative exercise. Figure 4 shows the effects of the simulated adaptation strategy as output percentage changes for 24 products of the Sri Lankan agricultural sector. The simulation projects that the outputs of 23 of the 24 products will increase in the long run, with nuts being the only exception. The decline in production of nuts in the long-run is attributable to the reallocation of both rainfed and irrigated lands used for nut cultivation in the baseline scenario to the cultivation of other crops, as indicated by the projected reduction of 1.35% in rainfed land and 14.98% in irrigated land for future cultivation of nuts under the SSP2 and RCP 8.5 scenario conditions. The highest percentage change in output is indicated by the tropical and other fruits sectors. This is because as mentioned in the table 11, the highest percentage of agricultural land area expansion is projected in the fruit sector.

The long-run expansion of agricultural land will add to production costs. However, due to the increased scale of production, outputs will also increase, offsetting the additional production costs and the prices of most agricultural sector commodities will decline (as indicated in Table 14). This emphasises the appropriateness of the adaptation strategy to counteract the potential threat of devastation for Sri Lanka of projected climate change scenarios. Similarly, an increase in household demand is projected for the majority of agricultural products. As discussed above, the output of nuts will decline, due to the reduction in land available for nut cultivation. An increase the price of nuts will follow, and a consequent decline in household demand for nuts.

|

Commodities |

Commodity Price |

Household Demand |

|

Cereals |

-16.37 |

10.22 |

|

Rice |

-1.66 |

4.4 |

|

Vegetables |

-17.76 |

10.29 |

|

Mushrooms and truffles |

4.21 |

1.16 |

|

Other Vegetables, fresh |

-3.77 |

5.27 |

|

Tropical and subtropical fruits |

-30.85 |

20.51 |

|

Other fruits |

-4.01 |

2.27 |

|

Nuts (excluding wild edible nuts and groundnuts), in shell |

12.11 |

-9.7 |

|

Oilseeds and oleaginous fruits |

-20.81 |

14.91 |

|

Coffee, green & Cocoa beans |

-6.02 |

3.77 |

|

Tea leaves |

-15.07 |

11.8 |

|

Stimulant, spice and aromatic crops |

6.91 |

-0.24 |

|

Sugar crops |

-3.09 |

0 |

|

Natural rubber in primary forms or in plates, sheets or strip |

-9.62 |

0 |

|

Unmanufactured tobacco |

-6.62 |

0 |

|

Forage products, fibres, living plants, cut flowers and flower buds |

-6.83 |

0.98 |

|

Live animals & Other animal products |

0.33 |

-2.18 |

|

Raw milk |

-1.79 |

-0.81 |

|

Eggs of hens or other birds in shell, fresh & Reproductive materials of animals |

-3.38 |

1.62 |

|

Support services to agriculture, hunting, forestry, fishing, mining and utilities |

-3.57 |

0 |

|

Logs of coniferous wood and non-coniferous wood |

3.71 |

0 |

|

Fuel wood, in logs, in billets, in twigs, in faggots or in similar forms |

-4.47 |

1.02 |

|

Non-wood forest products |

-3.35 |

4.88 |

|

Fish and other fishing products |

-5.6 |

0.4 |

Table 14: Percentage changes in household demand and agricultural commodity prices

The average output of agricultural manufacturing will increase by 4.72%, while the output from agricultural services will decline by 1.02%. The economy of Sri Lanka comprises limited resources (land, labour and capital), which must be shared by the three economic sectors. The labour input in most support services falling under the agricultural sector, has moved to other industries. As labour is an essential input for the services sector, a reduction in labour will reduce sectoral outputs.

Overall, the expansion of agricultural land area will support economic growth in the long-run, by curtailing the threat of climate change to agriculture. Similarly, alternative adaptation strategies can be assessed through ORANI-G-SL modelling, that policy-makers can arrive at informed decisions.

6 . Conclusion

This study has presented a new version of the ORANI-G model, the ORANI-G-SL, a single-country CGE model developed for Sri Lanka. The ORANI-G-SL incorporates water as a factor in agricultural sector production and allows for substitution between rainfed and irrigated lands. To the best of the authors’ knowledge, this is the first CGE model to differentiate between rainfed and irrigated agricultural land in Sri Lanka. However, similar studies have been performed in other countries. The paper provides a detailed description of the ORANI-G-SL’s adapted structure and the implementation of the model's database.

The new model facilitates the assessment of the economy-wide impacts of climate change and potential adaptation strategies to minimize the negative impacts of climate change in Sri Lanka. Thus, policy-makers can evaluate and prioritize adaptation strategies to mitigate the impacts of climate change, by assessing the economic effects. Further, it facilitates the modelling of green and blue water usage in the agricultural sector in Sri Lanka. We propose that this model be used to analyse the economic impacts of climate change in Sri Lanka, evaluate how enhancing irrigation capacity in the agricultural sector could sustain the national economy, and analyse the economy-wide impacts of adaptation strategies to mitigate climate change.

That the ORANI-G-SL only considers water usage in the agricultural sector is a drawback. Further development of the ORANI-G-SL model could surpass this limitation and incorporate domestic and industrial water usage.

The paper included two simulations confirming the accuracy of the model and demonstrating some of its features. Simulation 1 analysed the economic impacts of climate-induced agricultural productivity changes in Sri Lanka. The model output projected that future climate-induced agricultural sector productivity changes will cause the economy to contract. Declining agricultural productivity, and the associated reduction in overall food production in the country, will result in rising agricultural commodity prices. Furthermore, the reduced output of agricultural commodities will increase the demand for and, hence, the cost of land for crop production. This will impact negatively on aggregate employment and capital interest, resulting in a decrease in real GDP. These results confirm the need for mainstream adaptation strategies that can potentially offset the negative impacts of climate change on agricultural productivity.

The second simulation revealed the overall economic advantages of expanding agricultural land as a long-run adaptation strategy, appropriate for Sri Lanka. Not only does it predict increases in real GDP, household consumption, net exports, and the rate of employment, but will provide benefits for the vulnerable agricultural sector by improving the overall agricultural output, while reducing domestic market prices of the associated agricultural products.

Nonetheless, assessing the value of further other adaptation strategies should continue, as the expansion of agricultural land has a finite limit in the long run

7. References

- Ahmed M, & Suphachalasai S. Assessing the costs of climate change and adaptation in South Asia: Asian Development Bank 10(2014).

- Barrett CB. Measuring food insecurity. Science, 327(5967) (2010): 825-828.

- Berck P, Robinson S, & Goldman G. The use of computable general equilibrium models to assess water policies. In The economics and management of water and drainage in agriculture 5(1991): 489-509.

- Berrittella M, Hoekstra AY, Rehdanz K, Roson R, & Tol RS. The economic impact of restricted water supply: A computable general equilibrium analysis. Water research 41(8) (2007): 1799-1813.

- Calzadilla A, Rehdanz K, Betts R, Falloon P, Wiltshire A, et al . Climate change impacts on global agriculture. Climatic change 120(1) (2013): 357-374.

- Calzadilla A, Rehdanz K, Roson R, Sartori M, & Tol RS. Review of CGE models of water issues. In WORLD SCIENTIFIC REFERENCE ON NATURAL RESOURCES AND ENVIRONMENTAL POLICY IN THE ERA OF GLOBAL CHANGE : Computable General Equilibrium Models 3(2017): 101-123.

- Calzadilla A, Rehdanz K, & Tol RS. The economic impact of more sustainable water use in agriculture: A computable general equilibrium analysis. Journal of Hydrology 384(3-4) (2010): 292-305.

- Calzadilla A, Rehdanz K, & Tol RS. The GTAP-W model: Accounting for water use in agriculture 10(2011).

- Calzadilla A, Rehdanz K, & Tol RS. Water scarcity and the impact of improved irrigation management: a computable general equilibrium analysis. Agricultural Economics 42(3) (2011): 305-323.

- Calzadilla A, Zhu T, Rehdanz K, Tol RS, & Ringler C. Economy wide impacts of climate change on agriculture in Sub-Saharan Africa. Ecological economics 93(2013): 150-165.

- Cline WR. Global warming and agriculture: Impact estimates by country: Peterson Institute7(2007).

- De Costa W. Climate change in Sri Lanka: myth or reality? Evidence from long-term meteorological data. Journal of the National Science Foundation of Sri Lanka 36(2008): 63-88.

- De Costa W. Adaptation of agricultural crop production to climate change: a policy framework for Sri Lanka. Journal of the National Science Foundation of Sri Lanka 38(2) (2010).

- De Silva C. Climate Change Effects on the North-East Monsoon and Dry Zone Agriculture in Sri Lanka. Paper presented at the Global Climate Change and its Impacts on Agriculture, Forestry and Water in the Tropics, Kandy, Sri Lanka 6 (2009).

- Decaluwe B, Patry A, & Savard L. When water is no longer heaven sent: Comparative pricing analysis in a AGE model 10 (1999).

- Department of Land Use Policy Planning Sri Lanka. National Land Use Policy of Sri Lanka 4(2017).

- Dharmaratna D, & Parasnis J. Price responsiveness of residential, industrial and commercial water demand in Sri Lanka. University of Monash Discussion Paper 44(10) (2010) .

- Diao X, & Roe T. The win-win effect of joint water market and trade reform on interest groups in irrigated agriculture in Morocco. The political economy of water pricing reforms 7(2000):141-165.

- Dixon Parmenter BR, Sutton J, & Vincent DP. Orani, a multisectoral model of the Australian economy : North Holland 142(1982).

- Dixon Rimmer, MT, & Wittwer G. Modelling the Australian government's buyback scheme with a dynamic multi-regional CGE model: Centre of Policy Studies (CoPS) 8(2009).

- Eeswaran R. Climate Change Impacts and Adaptation in the Agriculture Sector of Sri Lanka: What We Learnt and Way Forward. In Handbook of Climate Change Communication2 (2018): 97-110.

- Esham M, & Garforth C. Climate change and agricultural adaptation in Sri Lanka: a review. Climate and Development 5(1) (2013):66-76.

- Godfray HCJ, Beddington JR, Crute IR, Haddad L, Lawrence, et al. Food security: the challenge of feeding 9 billion people Science 8 (2010): 1185383.

- Gohin A, & Hertel T. A note on the CES functional form and its use in the GTAP model 10(2003).

- Gomez CM, Tirado D, & Rey-Maquieira J. Water exchanges versus water works: Insights from a computable general equilibrium model for the Balearic Islands. Water Resources Research 40(10) (2004).

- Hertel TW, Burke MB, & Lobell DB. The poverty implications of climate-induced crop yield changes by 2030. Global Environmental Change 20(4) (2010): 577-585.

- ORANI-G: A general equilibrium model of the Australian economy: Centre of Policy Studies (CoPS) 3(2000).

- ORANI-G: A generic single-country computable general equilibrium model: Centre of Policy Studies and Impact Project, Monash University, Australia 10 (2003).

- Horridge M. DAGG Guide: A multipurpose freeware software package for manipulating and balancing databases. University of Monash, Melbourne, Australia 4(2001)

- Horridge M, & Wittwer G. SinoTERM, a multi-regional CGE model of China. China Economic Review 19(4) (2008): 628-634.

- Knox J, Hess T, Daccache A, & Wheeler T. Climate change impacts on crop productivity in Africa and South Asia: Environmental research letters 7(3) (2012): 034-032.

- Kohli, A, Frenken K, & Spottorno C. Disambiguation of water use statistics: The AQUASTAT Programme of FAO, Rome, Italy 7(2010).

- Lal M. Implications of climate change in sustained agricultural productivity in South Asia: Regional Environmental Change 11(1) (2011): 79-94.

- Lkhanaajav E. CoPS-style CGE modelling and analysis: Centre of Policy Studies (CoPS), Victoria University 5(2016).

- Mendelsohn R. The impact of climate change on agriculture in developing countries. Journal of Natural Resources Policy Research 1(1) (2008): 5-19.

- Mukherjee N. Water and land in South Africa: economywide impacts of reform--a case study for the Olifants river 10 (1996).

- Panabokke C, & Punyawardena B. Climate change and rain-fed agriculture in the dry zone of Sri Lanka. Paper presented at the Proceedings of the national conference on water, food security and climate change in Sri Lanka. water quality, environment and climate change. Colombo 2(2010): 9-11.

- Peterson Dwyer G, Appels D, & Fry J. Water trade in the southern Murray–Darling Basin. Economic Record 81(2005): 115-S127.

- Peterson DC, Dwyer G, Appels D, & Fry JM. Modelling water trade in the southern Murray-Darling Basin. 8(2004).

- Premalal K. Climate Change in Sri Lanka. Paper presented at the Global Climate Change and its Impacts on Agriculture, Forestry and Water in the Tropics Kandy, Sri Lanka 15(2009).

- Robinson S, & Gehlhar CG. Land, water, and agriculture in Egypt: The economywide impact of policy reform 7(1995).

- Robinson S, Mason-D'Croz D, Sulser T, Islam S, et al. The international model for policy analysis of agricultural commodities and trade (IMPACT): model description for version 3(2015).

- Rosegrant MW, Sulser TB, Mason-D’Croz D, Cenacchi N, et al. Quantitative foresight modeling to inform the CGIAR research portfolio: Intl Food Policy Res Inst 43(2017).

- Roson R, & Sartori M. System-wide implications of changing water availability and agricultural productivity in the Mediterranean economies. Water Economics and Policy 1(01) (2015): 1450001.

- Roson R, & Sartori M. Estimation of climate change damage functions for 140 regions in the GTAP9 database. University Ca'Foscari of Venice, Dept. of Economics Research Paper Series No 6 (2016) .

- Sahlén L. The impacts of food-and oil price shocks on the Namibian economy: The role of water scarcity. Umeå University 10(2008).

- Seung CK, Harris TR, MacDiarmid TR, & Shaw WD. Economic impacts of water reallocation: A CGE analysis for walker river basin of Nevada and California. Journal of Regional Analysis and Policy 28(1998): 13-34.

- Taheripour F, Hertel TW, & Liu J. Water reliability, irrigation adoption, and land use changes in the presence of biofuel production. 7(2013).

- Tirado D, Gomez CM, & Lozano J. Efficiency improvements and water policy in the Balearic Islands: a general equilibrium approach. investigaciones económicas 30(3) (2006): 441-463.